Notes on Tally ERP 9 By Ramanuj Purohit

What is accounting?

It is a systematic process of identifying, recording, measuring, classifying, verifying, summarizing, interpreting and communicating financial information. It reveals profit or loss for a given period, and the value and nature of a firm's assets, liabilities and owners' equity.

Accounts

Meaning of Account

Classification of Account

Rules of Accounting

Meaning of Account

A short descriptive records of a person, things, assets, income, profit or loss related use written in points is called Account. This is written in ascending order of date with certain rules.

Example

Bharat Trader’s Account

Dr (Debit) Cr(Credit)

|

Date |

Particular |

Amount |

Date |

Particular |

Amount |

|

|

|

|

|

|

|

There are two part of an account

a. Debit (Dr) Left side of the account book

b. Credit (Cr) Right Side of the account Book

“In tally, Account is called Laser.”

Classification of Account

Accounts are of 3 types.

a. Personal Accounts (ବ୍ୟକ୍ତିଗତ ଖାତା )

b. Real Accounts (ବାସ୍ତବିକ ଖାତା)

c. Nominal Accounts (ନାମମାତ୍ର ଖାତା )

Personal Accounts: -This is the account related to person, organization or company. Like Capital Account, Drawing Account, Ram, Bharat Traders, OLTS Pvt. Ltd, Bank Account etc.

Real Account

This is the account related to things or assets. Like Cash Ac, Furniture Account, Machinery account, Building Account, Land account, Motor account etc.

The Balance of real account is always in debit mode.

Nominal Account

This is the account related to Profit, Loss, Income and expenditure. This is also called Income Expenditure Account. Example Interest account, Discount Account, Commission Account, Wages Account, Purchase Account, Sales Account, salary account. The total of this account shows the annual Income or Annual Expenditure. At the end of the year, this account is been close after transferring to real account will be debit.

Rules of accounting

Rules of Personal Account (ବ୍ୟକ୍ତିଗତ ଖାତା ର ନିୟମ)

“Debit the receiver and credit the giver. “

It means as we know the person who gives something is creditor and who receive something is debtor. Whenever we transact always two accounts are impacted. Example we repay Ram Rs 1000 cash. As because Ram received the amount, So the account of Ram become debit. If I received 2000 from Shyam, then as because shyam give cash to us, so Shyam’s account become credit account. {N.B.:- whenever we pay or receive from someone, always two accounts are impacted. One is personal account and another is cash account (real account)}.

Rules of Real Account (ବାସ୍ତବିକ ଖାତା ର ନିୟମ)

Real & Personal Interaction: - “Debit what comes in and credit what goes out.”

Example” we repay Ram (Ram is a Personal Account) Rs 1000 cash (is a real Account). As because cash of Rs 1000 goes out, so the cash account becomes credit.

And in the case of Shyam (Shyam is a Personal Account) gives Rs 2000 cash (is a real account), here Rs 2000 cash comes in, so cash account becomes debit.

But In case the account of two side is of real account, in that case the

Real & Real Interaction: - “Credit what comes in and Debit what goes out.”

“Example:- I Purchased furniture of Rs 5000 cash. Here furniture comes and cash goes. So Furniture account will be credit and cash account will be debit.”

Rules of Nominal Account (ନାମ ମାତ୍ର ଖାତା ର ନିୟମ)

“Debit the Expenses and Losses & Credit the Income and Gains”

Example:- Unitty Computer Education pay its employee against salary Rs 15000 in cash. Here two accounts are impacted, one is salary account which comes under Nominal Account and another is cash account which comes under Real Account, So Salary Account will be debited as per the rules of Nominal Account and Cash Account will be Credited as per the Rules of Real Accounts.

Journal

When we maintain the transaction record, we do not enter directly to the account books. Firstly we write all the transaction to the journal according to the date and sale purchase series. When we enter some records in Journal, it automatically enters the data to the related accounts.

1. Meaning of Journal

2. Format of Journal

Meaning of Journal

According to commerce Journal is the record book where a trader write all the transaction record date and time wise in debit & credit with detailed description with its category.

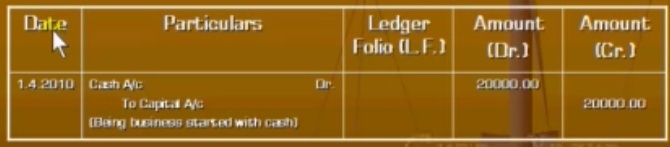

Format of Journal

How to enter transactions in journal

Bikash start a business in Rs 20,000/-

Details of Transaction

|

Sl |

Transaction Head |

Amount |

Impacted AC 1 and its type |

Impacted AC2 and its type |

|

|

1 |

Bikash start a business in |

20,000 |

|

|

|

|

2 |

Sold goods for cash to Mohan |

7000 |

|

|

|

|

3 |

Purhased Goods from Ram |

5000 |

|

|

|

|

4 |

Purchased goods for cash from Mohan |

7000 |

|

|

|

|

5 |

Purchased Building |

2000 |

|

|

|

|

6 |

Paid Wages |

200 |

|

|

|

|

7 |

Sold goods for cash |

2000 |

|

|

|

|

8 |

Proprietor withdraw cash for personal use |

500 |

|

|

|

|

9 |

Brought goods from Manoj |

5000 |

|

|

|

|

10 |

Made Payment to Manoj By Cheque |

5000 |

|

|

|

|

11 |

Sold goods to Ravi |

6000 |

|

|

|

|

12 |

Receive Cheque from Ravi |

6000 |

|

|

|

|

13 |

Paid Commission |

2000 |

|

|

|

|

14 |

Gave Loan to suresh on Interest |

5000 |

|

|

|

|

15 |

Receive cheque of Interest from Suresh |

500 |

|

|

|

Very Important Note while entering a Transaction in Journal

1. Which are the two account impacted

2. What are the type of those accounts

3. According to the rules of accounting, which account is to be credited and which to be debited.

Lets see the first transaction…

Bikash start a business with investing Rs 20,000/-

Here one account is cash account. But another account is not clearly mentioned. But as we know the business started, that means invest amount is called capital of business, so the another account is capital account.

Note:- There is no personal account of the proprietor to be opened, It is the capital account. We can say the capital account as the personal account of the owner. If there is more than 1 owner then the capital account is written as “Capital of Ramesh”, “Capital of Suresh”, “Capital of Bikash” etc.

The impacted capital account of relating to prakash, so it is personal account. : - receive=debit, give=credit

The impacted Cash account is Real Account. : - in=debit, out=credit

Example 2

Purchased goods from Ram Rs 5000

Here, the goods are purchased but not mentioned as cash, so this is a credit purchase

Here impacted accounts are: - Purchase account and Ram

Purchase account is Nominal Account à Debit

Ram’s Account is Personal Account à Credit

Purchased Goods

When it is written as “purchased goods” tat means it is a cash mode transaction.

Purchased Goods of Rs 5000/-

Accounts Impacted:-

1. Purchase Account (Nominal Account) its an investment so It is “Debit”

2. Cash Account (Real Account) it goes from business so it is “Credit”

|

Date |

Particular |

Laser Folio(L.F.) |

Amount (Dr.) |

Amount (Cr.) |

|

12.03.2017 |

Purchase A/C

To Cash A/C

|

|

5000.00

|

5000.00 |

Purchased Goods in Cash from Mohan of Rs 7000/-

|

Date |

Particular |

Laser Folio(L.F.) |

Amount (Dr.) |

Amount (Cr.) |

|

12.03.2017 |

Purchase A/C Dr.

To Cash A/C From Mohan traders |

|

7000.00

|

7000.00 |

Purchased Building in Rs 2,00,000/-

As because we are not purchasing building for sales. But we are going to use it as an internal property for business. So this building will be our asset and comes under “Real Account”.

Cash is “Real Account”.

Now we have two nos of account as “Real Account”. According to the rules of real account. Building account will be debit because it comes in to the business and cash A/C becomes credit as it goes out from business.

|

Date |

Particular |

Laser Folio(L.F.) |

Amount (Dr.) |

Amount (Cr.) |

|

12.03.2017 |

Building A/C Dr.

To Cash A/C

|

|

200000.00

|

200000.00 |

Paid wages Rs 200/-

Wages is the expense so it is a Nominal Account. According to rules it will be “Debit”

Cash is asset so it is Real account. According to rules it will be “Credit”

|

Date |

Particular |

Laser Folio(L.F.) |

Amount (Dr.) |

Amount (Cr.) |

|

12.03.2017 |

Wages A/C Dr.

To Cash A/C

|

|

200.00

|

200.00 |

Sold goods for cash Rs 2000/-

Cash is the Real Account. According to rules it will be “Debit” because it comes to business

Sale generates income so it will be the Nominal Account it will be “credit”

|

Date |

Particular |

Laser Folio(L.F.) |

Amount (Dr.) |

Amount (Cr.) |

|

12.03.2017 |

Cash A/C Dr.

To Sales A/C

|

|

2000.00

|

2000.00 |

Proprietor Withdrew Cash for Personal use Rs 1000

withdrawn by the owner of the business for personal use is called drawings. It is the Drawing Account. It is Personal Account. If owner is more than one person then it will be written as Drawing AC of Suraj, Drawing AC of Bikash etc. According to Rules it will be “Debit”

Cash Account is the Real Account according to rules it will be “Credit”

|

Date |

Particular |

Laser Folio(L.F.) |

Amount (Dr.) |

Amount (Cr.) |

|

12.03.2017 |

Drawing A/C Dr.

To Cash A/C

|

|

1000.00

|

1000.00 |

Sold Goods In Cash to Mohan Rs 6000/-

Account Name Cash Account Sales Accounts

Account Type Real Account Nominal Account

According to Rules “Debit” “Credit”

|

Date |

Particular |

Laser Folio(L.F.) |

Amount (Dr.) |

Amount (Cr.) |

|

12.03.2017 |

Cash A/C Dr.

To Sales A/C

|

|

6000.00

|

6000.00 |

Bought Furniture for Office 5000/-

As it is bought for regular use not for sale

Account Name Furniture Account Cash Accounts

Account Type Real Account Nominal Account

According to Rules “Debit” “Credit”

|

Date |

Particular |

Laser Folio(L.F.) |

Amount (Dr.) |

Amount (Cr.) |

|

12.03.2017 |

Furniture A/C Dr.

To Cash A/C

|

|

5000.00

|

5000.00 |